Overview

Why Engagement Feels Like the Only Metric in Influencer Measurement

Most influencer platforms focus on surface-level metrics like likes, follower counts, and shares—but these metrics rarely prove business impact. When marketers are under pressure to show ROI, engagement becomes the default metric—not because it’s the most meaningful, but because it’s often the only one available.

Influencer Measurement That Goes Beyond Promo Codes & Affiliate Link Tracking

StatSocial is the only influencer attribution solution to connect social campaign exposure to purchase behavior—both online and in-store. By linking social audiences to verified identities and purchase data, brands can finally measure true sales impact.

How Nestlé’s Attribution Study Uncovered a 25% Sales Lift

To move beyond engagement metrics, Nestlé partnered with StatSocial to measure the sales lift from their DiGiorno and Hot Pockets influencer campaigns. By mapping exposed social audiences to verified purchase data, they uncovered a 25% lift in spend among their brand’s own social following, with their influencer partners driving few sales.

Nestlé’s Findings

As a result of the influencer measurement study, Nestlé had two main findings. First, the influencers’ followings differed from the actual household purchasers, and second, Nestlé underestimated the impact of their own social channels.

The Hard Truth: Engagement Metrics are a Distraction

These metrics might look good in a deck if your campaign goes viral, but they don’t prove business impact. Leadership wants to know if the campaign drove real business outcomes—did it move product, shift perception, or increase sales? If all you can show is a spike in engagement, you’re not telling them anything they can take action on.

It’s time to stop pretending engagement equals effectiveness.

Why Engagement Feels Like the Only Metric

Most influencer platforms focus on the creator—follower counts, engagement rates, content formats and maybe sentiment metrics.

But do they answer the real question: Did the campaign drive sales?

With pressure mounting to prove ROI, traditional metrics, discount codes, and affiliate programs fall short—leaving critical questions unanswered:

- Did we reach the right audience?

- Did those audiences take meaningful actions?

- Did we see a measurable lift in conversions or sales?

There’s a solution that delivers these answers—giving both you and leadership the proof you need.

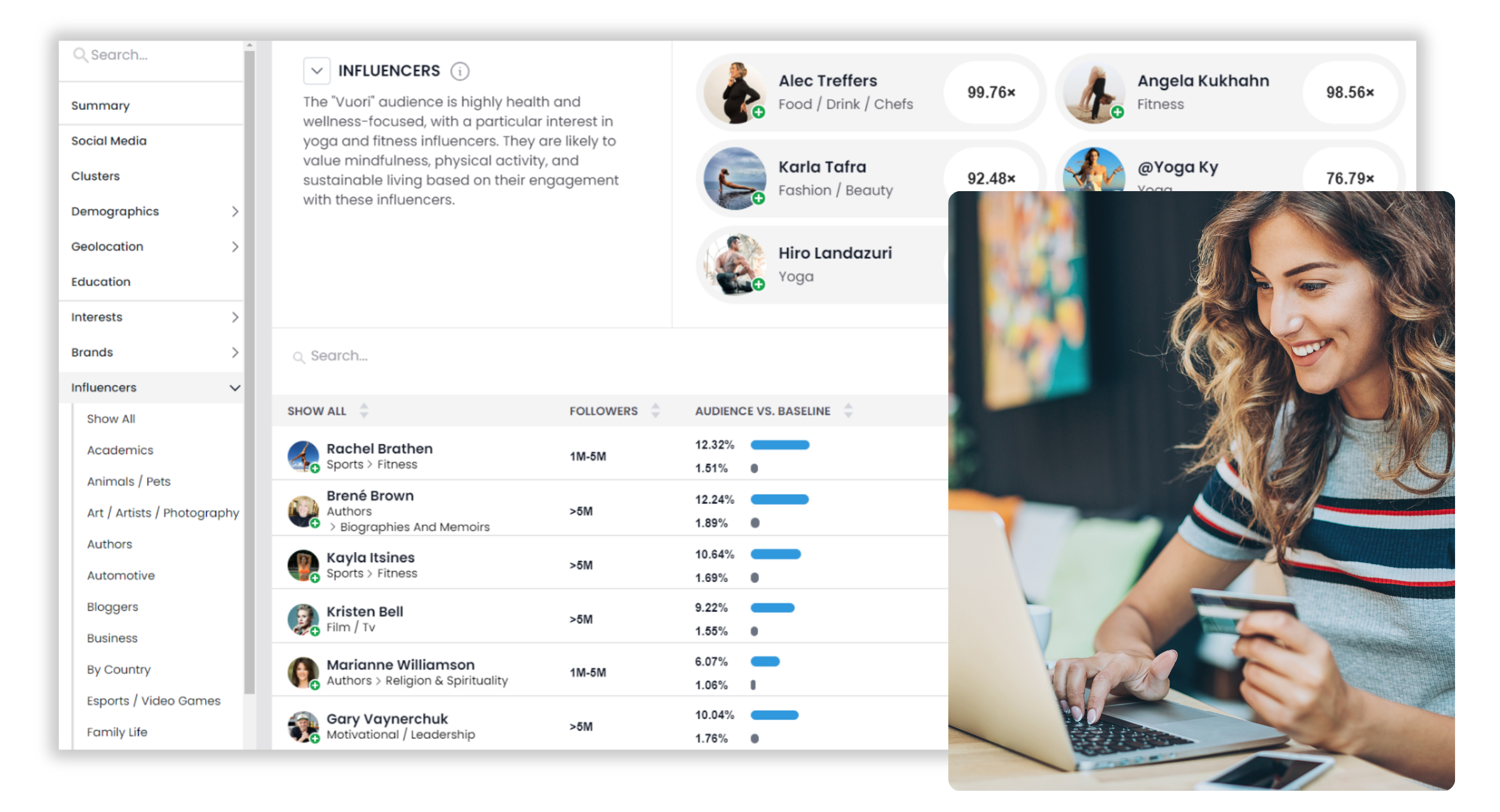

StatSocial Influencer Attribution: How It Works

Running an attribution study with StatSocial is relatively simple. As long as you have access to first or third-party purchase data, you can run an attribution study across any social campaign. Here’s how it works:

Audience Mapping

Through the StatSocial platform, you identify the social audiences exposed to your influencer campaign across major platforms. A non-exposed social audience (also known as a control group) is created to compare against.

Identity Resolution

These audiences are matched to real people using StatSocial’s proprietary Identity Graph.

Sales Lift

Connect those social audiences to purchase behavior—whether that’s an in-store or online purchase, subscription, or app install.

With StatSocial’s influencer attribution capabilities you gain in-depth reporting showing the campaign’s true performance, including incremental sales lift, repeat purchases, ROI, and more.

Unlike every other influencer platform that delivers likes, CTR, and promo code results, StatSocial delivers actual impact for future decision making:

- % of new buyers before, during, and after a campaign

- How much or how frequently an influencer’s following spent compared to the control group prior to, during, and after a campaign

- How much or how frequently your organic following spent compared to the influencer’s following prior to, during, and after a campaign

The difference is clear. If you want to grow your influencer marketing efforts you need StatSocial as a strategic partner to showcase the value to your leadership team.

How Influencer Measurement Works IRL:

Nestlé Measures 25% Sales Lift

Why Nestlé partnered with StatSocial

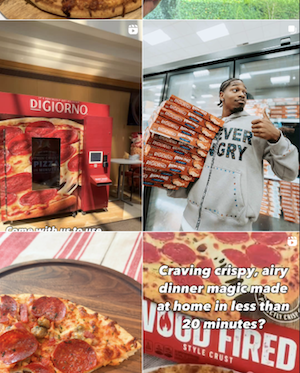

Nestlé launched a campaign to boost sales of their frozen food brands, DiGiorno and Hot Pockets, partnering with big names like NRG Sports and influencers IamDices, Vincent Marcus and Ross Smith. In parallel, they ran campaigns across their owned social accounts for both brands.

To optimize future campaigns and justify continued budget, the marketing analytics team partnered with StatSocial to directly measure sales impact—moving beyond traditional KPIs like engagement rates and follower growth.

Step 1

Within the StatSocial platform, Nestlé created audiences made up of those organically exposed to influencer and owned social content across major social platforms like Instagram, X, TikTok, and YouTube.

Step 2

Nestlé’s analytics team, in partnership with their purchase data provider, matched the exposed audience to point-of-sale purchase data over a 150-day period. They did the same for a control group of non-exposed social users with similar demographics and buyer behaviors to those exposed.

Step 3

Once each audience group was mapped to purchase data, Nestlé’s analytics team compared behavior across the exposed and unexposed groups before, during, and after the campaign in order to measure associated impact.

The Results

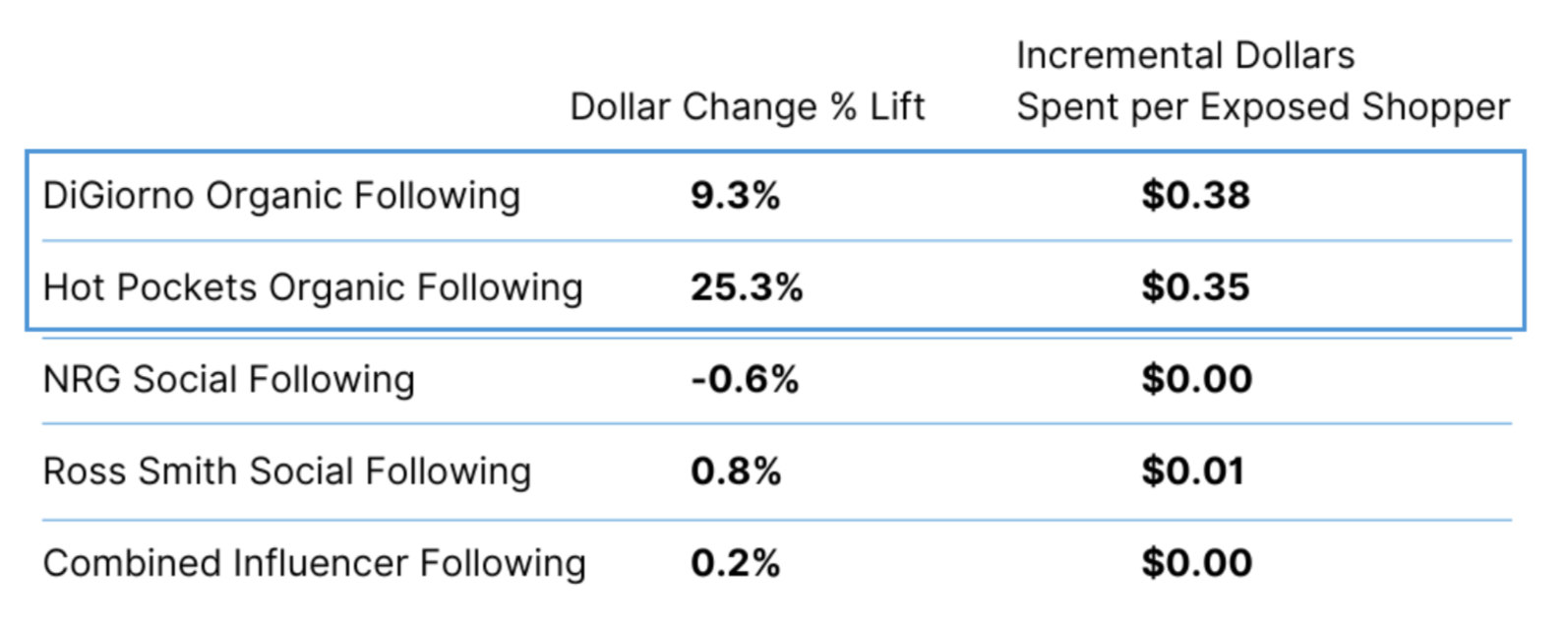

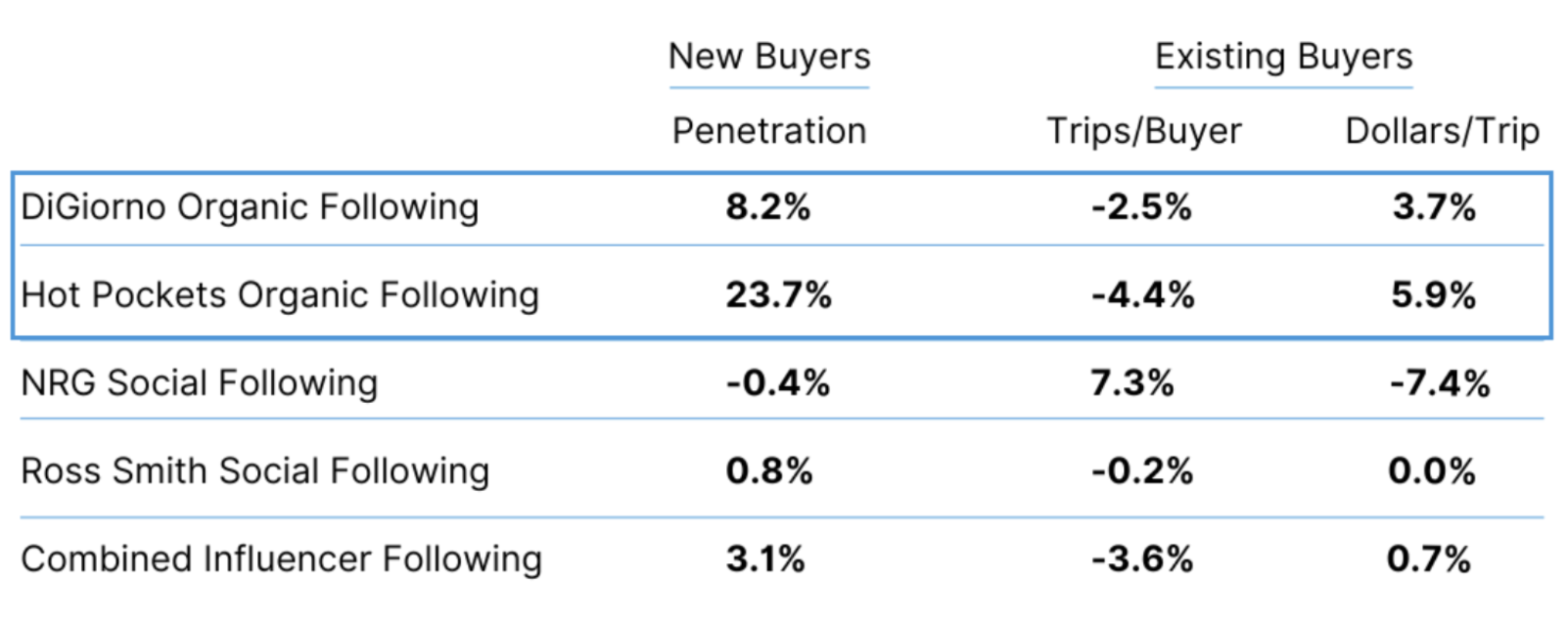

When Nestlé compared the exposed group to the non-exposed group across their own social followings and their influencer partners, they found that the exposed audience across their DiGiorno and Hot Pockets followings spent: 9.3% ($0.38) and 25.3% ($0.35) more than the non-exposed audience. Surprisingly the exposed audiences of their influencer partners showed much less of an impact across sales compared to the non-exposed, with leader Ross Smith demonstrating a .8% lift.

Nestlé’s Findings

Finding #1: The influencer audiences differed from the actual purchases

The influencers they partnered with targeted their end consumer (think, the 18-25 year olds eating hot pockets between classes and work shifts) versus the likely household shoppers– the parents and caregivers actually purchasing the product. Nestlé determined that future influencer campaigns should target more of the household purchasers.

Continuing to leverage the StatSocial platform, Nestlé could then identify existing and new audiences that were more likely to be household purchasers, and then reach them across influencer, media and retargeting campaigns. For example, influencer audiences similar to those following their owned DiGiorno and Hot Pockets channels.

Finding #2: Nestlé underestimated the impact of their own social channels and followings

Through the study, they found their own social following spent significantly more than the influencer audiences. Had Nestlé been unable to identify those organically exposed to their campaign with StatSocial, they might have incorrectly translated engagement to sales and made less informed decisions around future partnerships.

Regardless of their results though, this marked a significant milestone for Nestlé, enabling them to finally attribute real value to their social and influencer programs in the same way their peers in other areas of marketing have done for so long.

Ready to Ditch Your Current Way of Influencer “Measurement”?